Biosensors

To my readers, biosensors plummeted yesterday from massive selling.

It drops from a high of 1.565 to a low of 1.43 on the 17th of April. Eventually closing at 1.435.

On the 18th, it opens at 1.45. Reaching a high of 1.48 before collasping at 1.46 at closing.

So, what actually happened?

from Nomura

The share price of Biosensors pulled back today likely on a news report

– “Biodegradable Stent Safe for Long-Term Treatment of Coronary

Artery Disease”, Globe Newswire, 16 Apr 2012 – about safety issues

surrounding biodegradable stents after a 10 year long clinical study. The

limited clinical study showed the viability of a biodegradable stent for

treating coronary artery disease.

We believe the market reaction is misplaced. The idea of biodegradable

stents is not new. Indeed back in January 2011, Abbott Labs received

approval from the EU for its biodegradable ABSORB stent with the

company looking to commercialize it in late 2012 or 2013. Meanwhile

Abbott is doing further trials to support the marketing of the stent.

In this regard, the availability of competition from biodegradable stents or

indeed other stent platforms is not new. Biodegradable stents are still

very new to the market and will take some time for clinical data to

reassure doctors on its safety, efficacy and deliverability. Meanwhile,

biodegradable polymer stents appear to be showing increasing evidence

of superior results compared to durable polymer stents as evidenced by

Biosensors LEADERS trial.

We continue to maintain our Buy rating for Biosensors with a price target

of S$1.84

In a nutshell, there is some safety concerns regarding Biosensors. As they does healthcare businesses, the stents( tubes) that they manufactured are used to insert into the body of the patients. As safety concerns are raised, the share price took a huge hit.

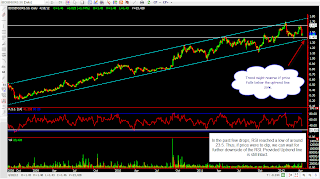

So, from a chart point of view, how can we analyse or I attempt to analyse.

This, is how i attempt to use elliot wave for explaination. If a formation of wave 2 had occur, we could then take a look at jumping to buy near the trough in wave 2. ( no one knows where is the bottom going to be) However, if pattern is still intact, we can progressively buy in after we see formation of 2, which could likely be formed near the bottom uptrend line.

Fundamentally, they seem to have no problem and seems to have huge growth potential looking at the financial ratios. Extracted from shareinvestor. see below

I will definitely be relooking back at this chart in the near future.

Disclaimer : This is not a buy/sell call

It drops from a high of 1.565 to a low of 1.43 on the 17th of April. Eventually closing at 1.435.

On the 18th, it opens at 1.45. Reaching a high of 1.48 before collasping at 1.46 at closing.

So, what actually happened?

from Nomura

The share price of Biosensors pulled back today likely on a news report

– “Biodegradable Stent Safe for Long-Term Treatment of Coronary

Artery Disease”, Globe Newswire, 16 Apr 2012 – about safety issues

surrounding biodegradable stents after a 10 year long clinical study. The

limited clinical study showed the viability of a biodegradable stent for

treating coronary artery disease.

We believe the market reaction is misplaced. The idea of biodegradable

stents is not new. Indeed back in January 2011, Abbott Labs received

approval from the EU for its biodegradable ABSORB stent with the

company looking to commercialize it in late 2012 or 2013. Meanwhile

Abbott is doing further trials to support the marketing of the stent.

In this regard, the availability of competition from biodegradable stents or

indeed other stent platforms is not new. Biodegradable stents are still

very new to the market and will take some time for clinical data to

reassure doctors on its safety, efficacy and deliverability. Meanwhile,

biodegradable polymer stents appear to be showing increasing evidence

of superior results compared to durable polymer stents as evidenced by

Biosensors LEADERS trial.

We continue to maintain our Buy rating for Biosensors with a price target

of S$1.84

In a nutshell, there is some safety concerns regarding Biosensors. As they does healthcare businesses, the stents( tubes) that they manufactured are used to insert into the body of the patients. As safety concerns are raised, the share price took a huge hit.

So, from a chart point of view, how can we analyse or I attempt to analyse.

This, is how i attempt to use elliot wave for explaination. If a formation of wave 2 had occur, we could then take a look at jumping to buy near the trough in wave 2. ( no one knows where is the bottom going to be) However, if pattern is still intact, we can progressively buy in after we see formation of 2, which could likely be formed near the bottom uptrend line.

Fundamentally, they seem to have no problem and seems to have huge growth potential looking at the financial ratios. Extracted from shareinvestor. see below

I will definitely be relooking back at this chart in the near future.

Disclaimer : This is not a buy/sell call

Comments

Post a Comment