Update On Sakari (1)

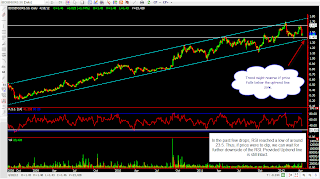

Below are some charts which shows the Dow Jones U.S. Coal Index Stock prices. Sakari share price, together with the Dow Jones Coal Index prices have taken a hit. Coal spot price seems to have a support at 200 USD. Other major U.S companies coal companies such as Peabody and Alpha Natural share prices are also on a declining trend as well. Coupled with slowing growth of China, which is a huge importer of coal, the outlook of Sakari does not seem to be as rosy as before. Just to take note as the Coal prices index that i am using is not the Indonesia Coal spot prices, but valuation As Coal prices seems to have rock bottom, it is best to avoid coal related companies at the moment. As Sakari is the only Coal company listed in SGX, investors can only gain exposure to coal related companies through them. Support/Resistance at 2.100 , 1.97-2.00 , 1.800 . Do take note at these key support and resistance levels as potential reversals might occurs at these levels. Do t