Harmonic VSA Week 1

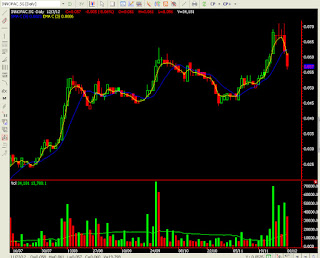

My First Forex post. Firstly, please take a look at the link below. http://harmonicforex.com/wp-content/uploads/2012/12/euraudbat.png Stolen from Gump's website. If you do not know, Terry is a fx trader and is the founder of his own website of harmonicforex.com. On the month of December, he is up by 60% of his portfolio. Unbelievable if you were to ask me. As I mentioned that I will be doing FX too, Gump will be guiding me in learning harmonic while I try to provide some analysis, using SVSA. Of all the pairs that he mentioned, I am very interested in this pair, EUR/AUD Bat. Possible Entry, profit taking level will be.... Entry : 1.2733 Exit : 1.2834 Profit Taking Level : 1.2550 Notice the ultra high volume shown on the chart. This will provide some kind of support for this pair which I am wary of. Thus, my profit taking level will be closed to the bar over there. An updated post on 12/31/2012, 3:53 PM GMT On top of the EUR/AUD that I mention, USD/CHF is lo