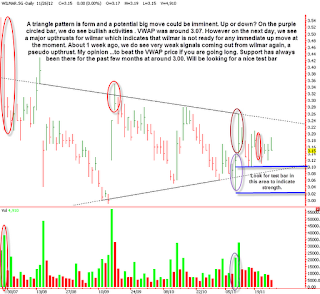

United Engineer - Diary Post

Emailed my clients about UE breakout trade on Thursday. Image is chart on Thursday. I did not tell my clients much as most of them are non-TA practioners. Price has now up by 8 cents. How far up will it go? $2.80 and recapture new high? Why not? 100 years special dividend incoming? Perhaps... However, most peole who follow my blog know that I am not a breakout trader, but seeing the strength behind UE... I thought it is reasonable to still have some upside.