Diary Post -Pre-Week 4

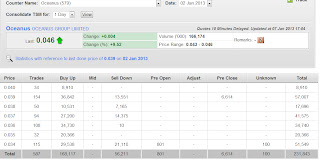

A fantastic week 3! Some of the posts really ran like mad bull. Geo, which took quite a while before they finally moved never disappointed me! Yoma, up like 20 percent as for price that I posted. Biosensor totally moves in how I expected them to move. KSH, the star of small cap ppty stock also won a new contract and pushes close to its previous level. I think there are others on the blog here and some which wasn't discussed over here too. The two China veggies stocks, CMZ and Sino continues to chiong and Sino continues to chase CMZ, possibly a 1 dollar stock soon. @ Current market condition ....it is very hard to spot in stocks as most of the stocks are in their highs. The most important thing has always been good risk management. Below are some of the stocks that I am watching at the moment. Bumitama Aspial Potential entry : 430-435 CCFH CSE global Waiting for a shakeout.