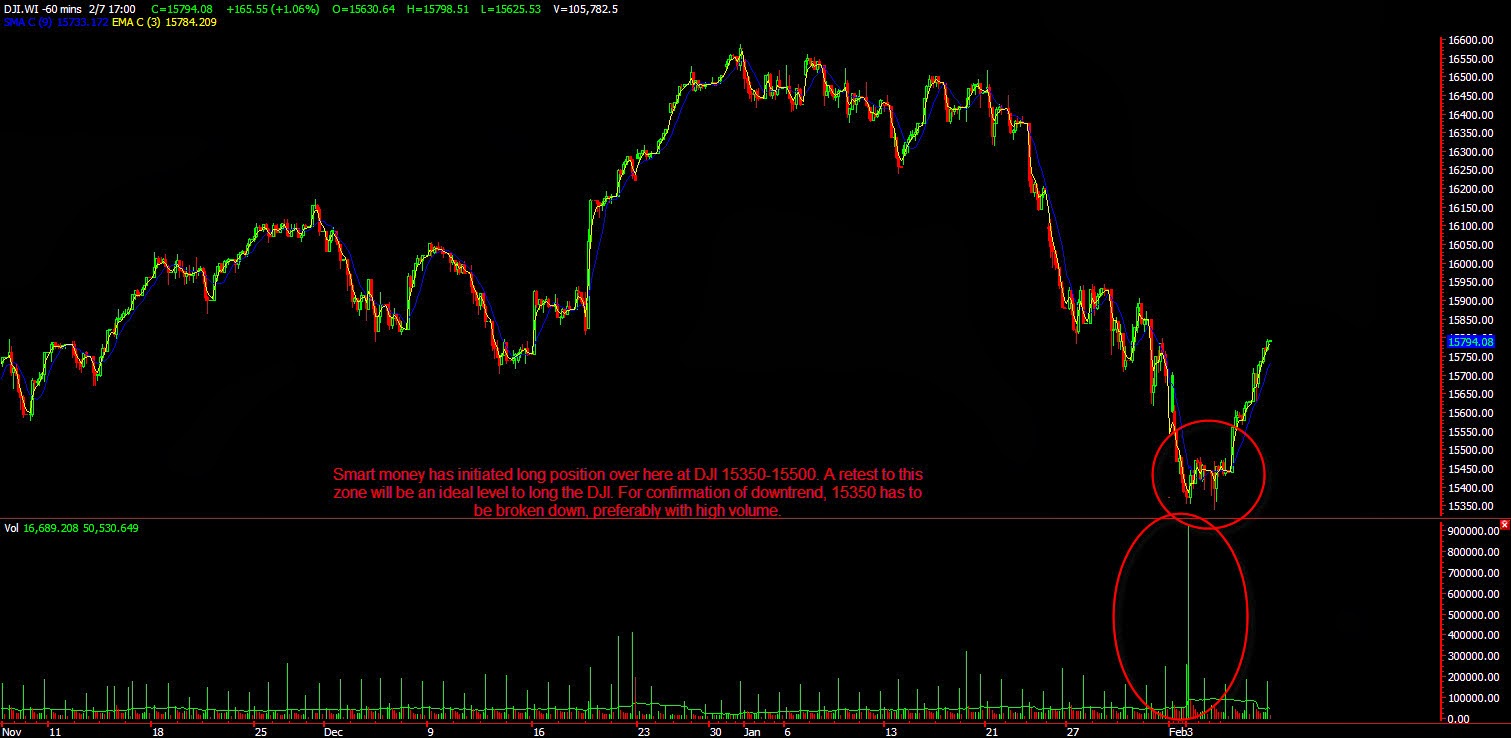

An update on DJI and STI since 9th feb....

An update on DJI and STI since 9th feb.... DJI fails to break the 16250 resistance yesterday and was thrown back to support at around the 16000 region. A break below 15850 could mean that DJI will turn bearish again. At the moment, there are multiple support level on the DJI at around 15900 region and 15700 region. For our local index, the STI is still on a mid term down trend until the 3140 level is conquered. Meanwhile, STI has rallied close to 120 pts, 4 percent approx since the low of 2960 was reached. However, do take note that in the meanwhile, index heavy weights such as Singtel, JSH, JMH, Jardine C&C, OCBC are the main gainers throughout this minor (suckers) rally? I wouldn't be too convinced until trend channel is broken. Do pay attention to the gap up of the STI yesterday. Suspicious gapped up with strong volume could indicate that the smart money has already left the market. Any break of recent support of the STI could means we might have potentially hit...