RE : On Dukang

A post that I made quite a while back on Dukang, more than 1 month ago.

While most of the investors punters are interested in getting quick profits, more often than not, they are being squeezed by the big boys who controls and knows the game is being played much better.

As a remiser/dealer myself, I have the privilege to understand the meaning of letting winners ride. Most of my clients who buy good stocks are reaping their rewards from the bull market and it is usually the contra players that contributes to their gains. You probably need an accuracy of more than 70 percents if you do short term trading.

As a remiser/dealer myself, I have the privilege to understand the meaning of letting winners ride. Most of my clients who buy good stocks are reaping their rewards from the bull market and it is usually the contra players that contributes to their gains. You probably need an accuracy of more than 70 percents if you do short term trading.

Letting the winners ride

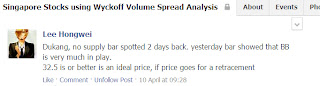

To illustrate you a scenario, below is an example of Dukang Distillers which I manage to spot its accumulation back when it was trading at low 30++cents.

If you are lucky, you probably would have caught the ride on the 18th April which should net you some decent profits.

If you are lucky, you probably would have caught the ride on the 18th April which should net you some decent profits.

However, share price has now rises more than 10 cents since the "2nd circled bar" on my chart.

So, technically, you missed out an additional 25 percent gains....

So, technically, you missed out an additional 25 percent gains....

One good thing that I like using VSA/wyckoff is that it allows me to look at the market on a "On-the-go" basis. If there is no key reversals or signals to get out, I will not get out. If bars and trends are still doing very well, I remain in the game. This is especially so if both the charts and the fundamental do aligned.

I still remember I took a second look on Dukang was because of a particular research report, highlighting its potential and dukang being deeply undervalued.

Comments

Post a Comment