KEP REIT

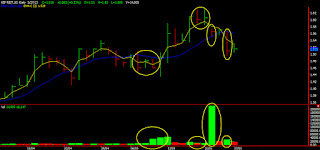

Below is a chart analysis on Kep Reit.

Kep Reit got my attention after the huge spike recently on May 13. With a very wide spread bar with decent volume.

Looking a few days prior to the day swing, (first set of circle), strong accumulation had already taken place when KepReit shares were credited to KepCorp shareholders. (kcorp has given their share holders 200 shares of Kreit for every lot of shares of Kcorp they holds).

This had lead to strong selling from the public which the SM, stealthly collected them which explains the strong volume.

May 16-20 bars are all dubious very dubious. While the background is strong with affirmed accumulation, the 3 bars that were seen exhibits weak wililingness to follow through. (Anyway, the price then was too far away from accumulated prices and you run the risk)

3rd circles show an ultra high volume bar gap down bar. The summary as posted probably explains the dubious volume. Married trade with 180 lots of volume. However, even discounting the strong volume, volume is still high which might concludes that the May 16-20 bars are likely profit taking bars.

4th bar is caused by weak fundamental news coming from all over the world. Bond rates/ weak econ data from major countries etc that explains the sharp drop in price. Nothing spectacular but mainly panic to me.

Where to go next?? On 22 May, Goldman Sachs announced that they will buy Keppel REIT Stake for S$279.9 Million and will forms about 6.7% of Kreit major sharesholder.

With that in mind, on Thursday, I thought it was an opportunity to go long on Thursday (how often do we beat Goldman Sachs buying prices) and also most importantly, Kep Reit is trading at the low of the trading range. The risks is still there because the test might fails too. But even if it does, damage should be little. As per told to my clients, the next level that you should be looking at if $1.5 fails to support will be price regions in the first accumulation.

Kep Reit got my attention after the huge spike recently on May 13. With a very wide spread bar with decent volume.

Looking a few days prior to the day swing, (first set of circle), strong accumulation had already taken place when KepReit shares were credited to KepCorp shareholders. (kcorp has given their share holders 200 shares of Kreit for every lot of shares of Kcorp they holds).

This had lead to strong selling from the public which the SM, stealthly collected them which explains the strong volume.

May 16-20 bars are all dubious very dubious. While the background is strong with affirmed accumulation, the 3 bars that were seen exhibits weak wililingness to follow through. (Anyway, the price then was too far away from accumulated prices and you run the risk)

3rd circles show an ultra high volume bar gap down bar. The summary as posted probably explains the dubious volume. Married trade with 180 lots of volume. However, even discounting the strong volume, volume is still high which might concludes that the May 16-20 bars are likely profit taking bars.

4th bar is caused by weak fundamental news coming from all over the world. Bond rates/ weak econ data from major countries etc that explains the sharp drop in price. Nothing spectacular but mainly panic to me.

Where to go next?? On 22 May, Goldman Sachs announced that they will buy Keppel REIT Stake for S$279.9 Million and will forms about 6.7% of Kreit major sharesholder.

With that in mind, on Thursday, I thought it was an opportunity to go long on Thursday (how often do we beat Goldman Sachs buying prices) and also most importantly, Kep Reit is trading at the low of the trading range. The risks is still there because the test might fails too. But even if it does, damage should be little. As per told to my clients, the next level that you should be looking at if $1.5 fails to support will be price regions in the first accumulation.

Comments

Post a Comment