RE : Singapore Market In Focus - STI and Quarterly Result Cautions

Good Afternoon all,

Sorry for the lack of updates. Definitely been watching the market as it is my job but been lazy to post.

Below are my views on the current market and might not be correct, just my own personal opinons.

First of all, this is not a buy/sell recommendation and merely my 2cents in how i feel the market is responding.

1 month back, STI retraces from its low of around 2700 and reaches the 3000 recently. On its route there then the top 20 volume is pretty much dominated by blue chip coutners/mid cap. (Eg golden agri was at about 58 cents then)

2 weeks ago, we see a resurgence of the penny counters again, TT Int, GSH corp, Unifiber etc. All of them churning out good volume and lured investors/gamblers into buying them. (As these counters have no basis in the foundation, buying these counters in my opinon is equivalent to gambling - no offense) At the moment, these penny counters are all down from their highs, likely profit taking had taken place.

Usually when we see the rallying and then dying of penny counters, this might signify an end of a bull run.

So far, the month of July has been mixed. Most investors are hoping for a monetary stimulus from the central bank of US, to aid the global ailing economy. However, during their last meeting, he mentions that they are looking at the possbility of providing another round of stimulus, be in QE3/lowering interest rate. Thus, the market did not move as much as people who long the market hoped for.

I had been preaching about the 3000 and 3030 resistance levels and I feel that this 2 supports and resistances will form a basis on where the market direction will be.

Hopefully we can stay above the 3000 level for the STI components and coupled with good financial results to be released, can we see possible pushs and beyond? Unlikely, unless US and China came out with some easing to their respective economies.

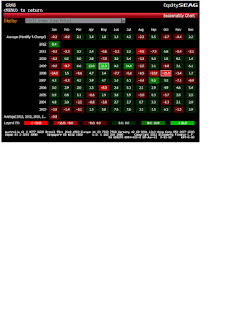

Attached below is a bloomberg grab screen on the historical trends of the past 10 years of STI components.

On the month of august, STI components net a negative of -2.3% returns overall for the past 10 years.

Will this trend continue? I feel that as the earnings result are released ( whether good or bad), people who has longed probably will sell off their shares. With STI also at its resistance now, this give investors more reasons to sell their shares. Buying on earnings results in my opinon are especially dangerous for investors who buy due to their past quarterly result.

In conclusion : Invest within your limits and secure your profits.

Comments

Post a Comment