Thoughts on the China/Hk Bull .....

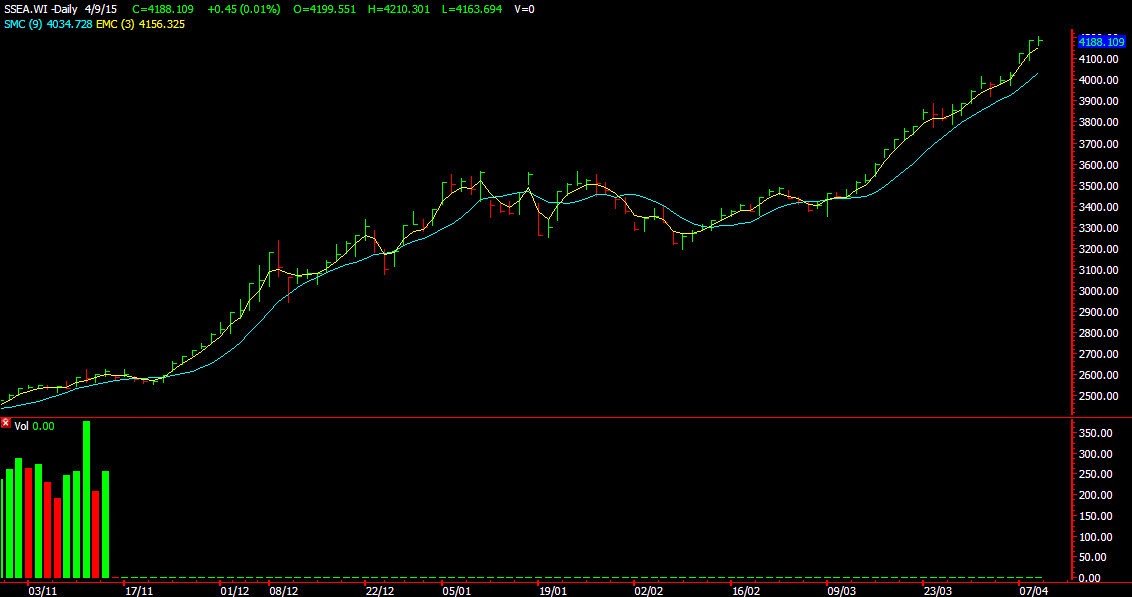

Over the last 2 days, both China and HongKong market were up by a ridiculous amount. See attached.

When I was still with my ex employer, one of my colleague cum mentor told me not to waste much time on the Singapore market.

"Look at the market where the funds are, you will be greatly rewarded", he said.

Indeed, he was really right. There was no turning back once I look at the HongKong and China market as it was during the time when the HongKong Shanghai connect was about to start. Thus, my focus was very much on the potential bull. Market was massively positioned for the bull but what about my clients (ex clients) who the majority are based in Singapore or are Singaporeans? They couldn't give care less as they have no experiences on foreign markets and they are afraid of venturing into more uncertainty in the world of stock market.

Below is the screenshot of CGS (6881.hk) , probably the call of the year. :P

The idea behind the call was simple : MSCI addition & Potential China Bull market. Call till date is probably 80% for 6months.

I was heavily monitoring the HK market for the last 6 months. Pingan/CCB/China Mobile/HongKong Exchange/Sound Global and many others. And in the same time, OCBC was trading at $10.50 6 months ago and it is trading at $10.60 now... Get me?

Maybe I have not experience in the bull market yet prior to the bull charge in the China/HongKong Market. The US bull from 08 till now doesn't really impacted that much on me because 1) I was still a young dealer then. 2) I didn't really monitor the US market that closely in terms of their 2nd liner/3rd liners. Thus, it is my first time experiencing such overwhelming volume and price surges on a single market.

How long will the China/HongKong bull stays? Probably till Q3 of 2015? But at the moment, lots of good blue chips like HongKong Exchange does indicate to me that the buying up is pretty genuine. While risk is a little high now for the majority of the stocks, any pull backs could be a potential entry. Please do your own homework. :D

Lastly, below is the screen capture from marketinout.com. Do take note that it is just a mid day scan and the amount of stocks that is trading 100% from its volume average is alarming..

To Subscribe to marketinout.com with a discount, do use 45K2D47BXG as the discount code!

When I was still with my ex employer, one of my colleague cum mentor told me not to waste much time on the Singapore market.

"Look at the market where the funds are, you will be greatly rewarded", he said.

Indeed, he was really right. There was no turning back once I look at the HongKong and China market as it was during the time when the HongKong Shanghai connect was about to start. Thus, my focus was very much on the potential bull. Market was massively positioned for the bull but what about my clients (ex clients) who the majority are based in Singapore or are Singaporeans? They couldn't give care less as they have no experiences on foreign markets and they are afraid of venturing into more uncertainty in the world of stock market.

Below is the screenshot of CGS (6881.hk) , probably the call of the year. :P

The idea behind the call was simple : MSCI addition & Potential China Bull market. Call till date is probably 80% for 6months.

I was heavily monitoring the HK market for the last 6 months. Pingan/CCB/China Mobile/HongKong Exchange/Sound Global and many others. And in the same time, OCBC was trading at $10.50 6 months ago and it is trading at $10.60 now... Get me?

Maybe I have not experience in the bull market yet prior to the bull charge in the China/HongKong Market. The US bull from 08 till now doesn't really impacted that much on me because 1) I was still a young dealer then. 2) I didn't really monitor the US market that closely in terms of their 2nd liner/3rd liners. Thus, it is my first time experiencing such overwhelming volume and price surges on a single market.

How long will the China/HongKong bull stays? Probably till Q3 of 2015? But at the moment, lots of good blue chips like HongKong Exchange does indicate to me that the buying up is pretty genuine. While risk is a little high now for the majority of the stocks, any pull backs could be a potential entry. Please do your own homework. :D

Lastly, below is the screen capture from marketinout.com. Do take note that it is just a mid day scan and the amount of stocks that is trading 100% from its volume average is alarming..

To Subscribe to marketinout.com with a discount, do use 45K2D47BXG as the discount code!

Comments

Post a Comment