On the Hongkong and China Market

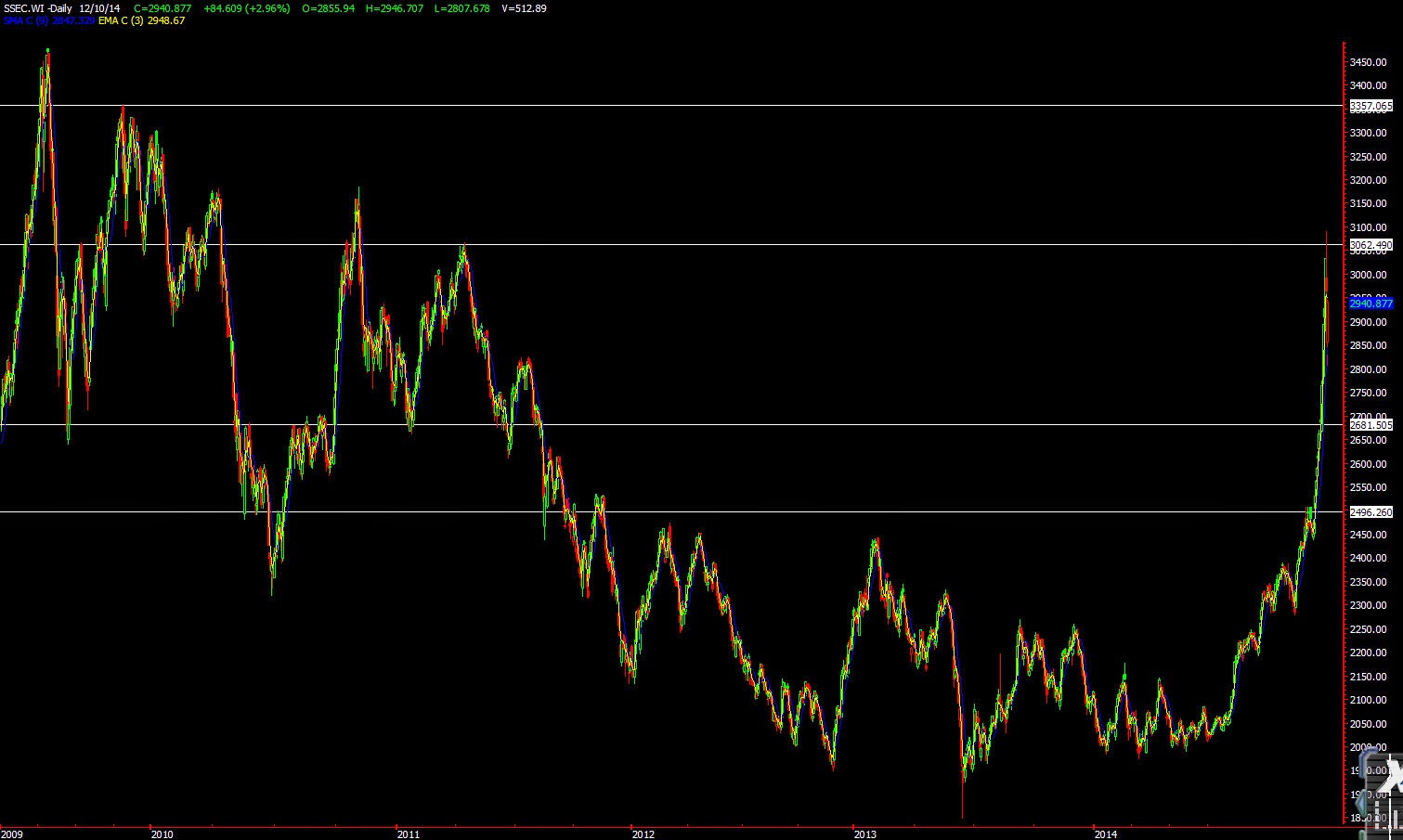

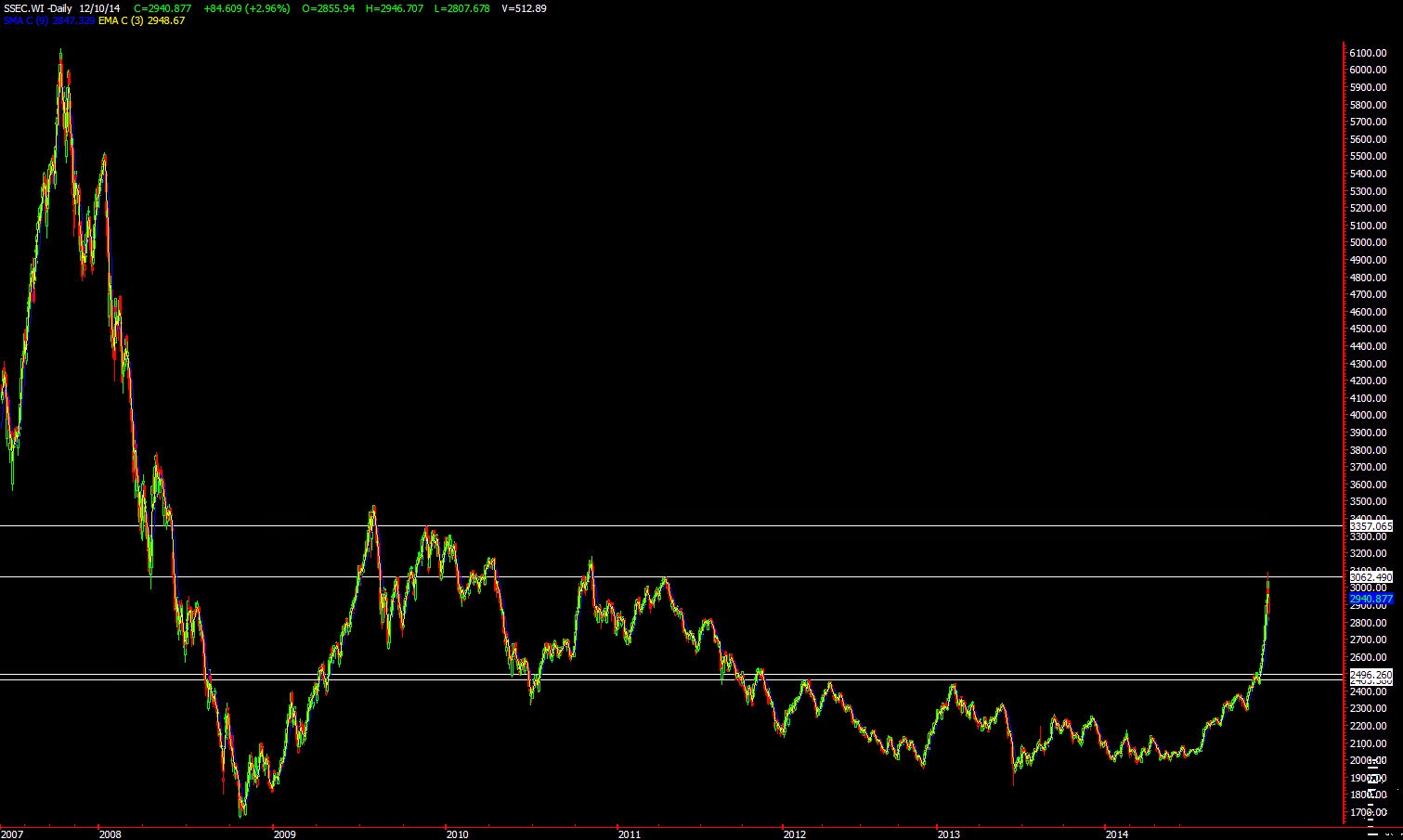

2827- an ETF that tracks China CSI 300 has been on impressive gains along with the HongKong market (Duh). With the connectivity between them and HongKong now, any sneezes that is felt in China will be even more sensitive to the HongKong market from now on. 2827 will give investors the needed exposure to invest in their Index. I have also drawn the key support lines of both the SSEC and 2827.hk

The China Index reaches 6k points back in 07, right now we are at 3k pts. The question is whether their government/exchange can revive this sleeping giant and get retailers investors to start investing again.

The table below shows the dates when the China index had a 5% or more correction.

The first column shows the date. The second shows the magnitude. The third column shows the return of the index in the corresponding day and the fourth column shows the return in the next month.

While the table does shows a skewed positive bias return on the following day after a more than 5 % drop. Coincidentally, the China Index rebounded 80++ pts, approx 3% after the sharp drop on Tuesday. But the return on the following months I thought is rather more impressive, upon calculation, standard deviation on its next month return is approximately 8%, not too bad.

Comments

Post a Comment