End of May Update and Marketinout

May was a pretty good month for our Singapore stocks as most of the stocks were in green. While the blue chips didn't trigger a much anticipated fear, my facebook page benefited greatly from the impending heads up given by myself and some of the members. You can check out the fb forum here. We welcome all people, whether if you are learning or already a seasoned trader.

The list of stocks that were highlighted as it was pretty long list. Do visit my fb page if you want to see all the past and present heads-up given by members and I. However, I will like to take this opportunity to thank Marketinout.com for the market scans that they had provided me with it and also all the members that had contributed!

Many of my members asked me how I benefit from the scans, well it is simple...Volume spread analysis takes advantage of unusual volume and the scan allows us to scan for the stocks with such criteria, whether it is intraday or end of day. More effectively, the no. of criteria that one can adjust and input into it helps make filtering stocks or "exploding" stocks rather easy. Especially in the good market like the month of May (similar to the early months of 2014), you pretty much earn money on whatever you buy. It is about the opportunity costs and I dare to say marketinout is really a good useful tool.

Of course, much will rely on the techniques, setups of a VSA/Tape reader trader as well. A scanner just takes away part of the tedious job.

Do click on the link here and sign up for a free trial if you haven't. This is the coupon code that i got from the vendor. Enjoy a 20 percent% of for their services by using 45K2D47BXG as coupon voucher.

Also, for those who had subscribed to the marketinout.com , please leave me an email @ sgwyckoffvsa@gmail.com and I will take my time and teach you personally how to correctly scan for stocks effectively via a one-one webinar session.

-------------------------------------------------------------------------------------------------------------------------

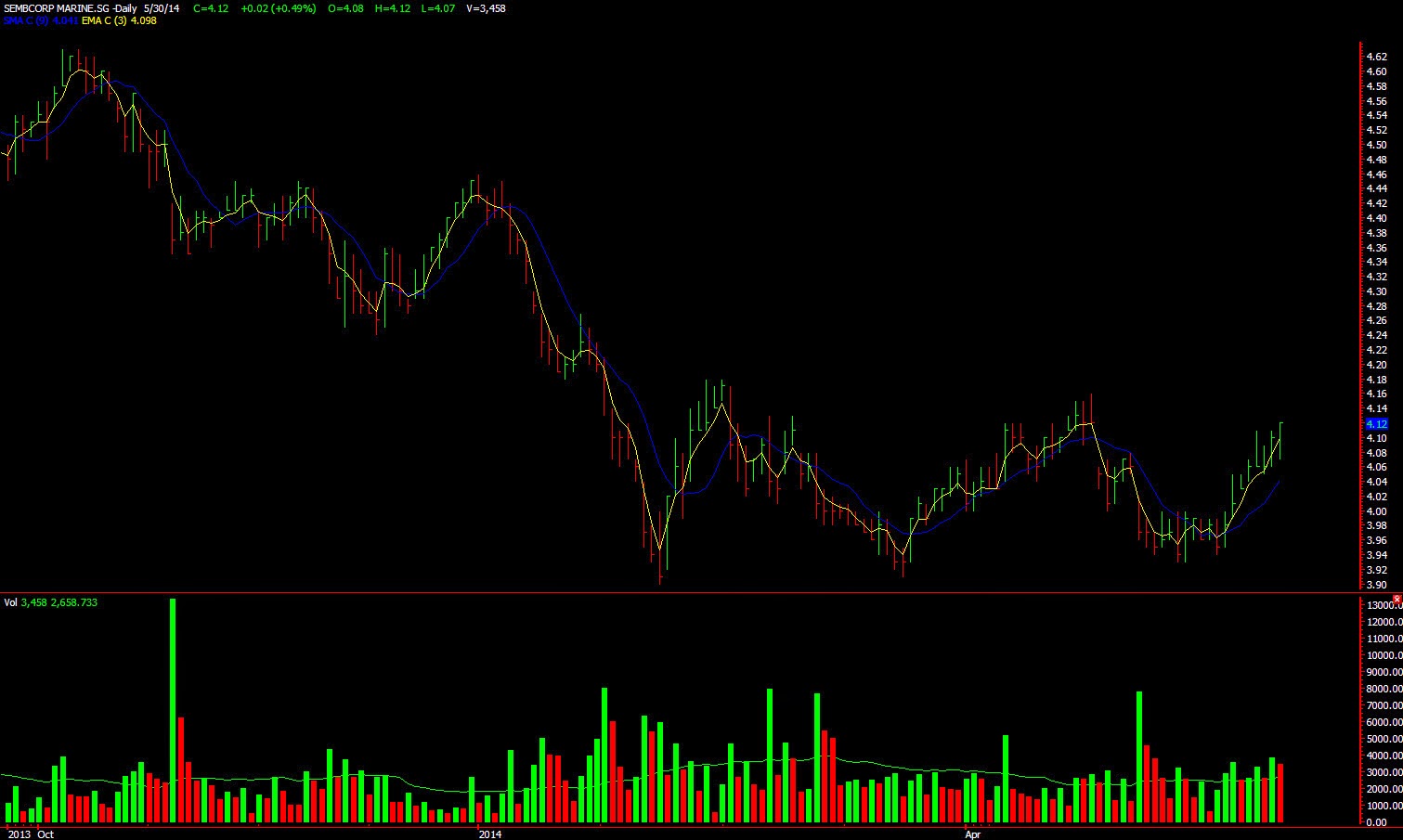

Last Friday was window dressing but there was one particular that caught my attention before Friday's spurt. It was Sembcorp marine. Not much about its fundamental as I believe most analyst house has a fundamental strong buy call on SembCorp Marine...

See the similarities between this 2 stocks, Hankore & Yangzijiang. And also the news that had happened. Early this May, Hankore also had similar news.... Yangzijiang could potentially do a "hankore". Watch out for the no supply bar. Interestingly, sell down occurs on window dressing, volume could be exaggerated but I wouldn't be surprised if share prices were whacked down purposefully.....But do not catch a falling knife. Please practice risk management.

The list of stocks that were highlighted as it was pretty long list. Do visit my fb page if you want to see all the past and present heads-up given by members and I. However, I will like to take this opportunity to thank Marketinout.com for the market scans that they had provided me with it and also all the members that had contributed!

Many of my members asked me how I benefit from the scans, well it is simple...Volume spread analysis takes advantage of unusual volume and the scan allows us to scan for the stocks with such criteria, whether it is intraday or end of day. More effectively, the no. of criteria that one can adjust and input into it helps make filtering stocks or "exploding" stocks rather easy. Especially in the good market like the month of May (similar to the early months of 2014), you pretty much earn money on whatever you buy. It is about the opportunity costs and I dare to say marketinout is really a good useful tool.

Of course, much will rely on the techniques, setups of a VSA/Tape reader trader as well. A scanner just takes away part of the tedious job.

Do click on the link here and sign up for a free trial if you haven't. This is the coupon code that i got from the vendor. Enjoy a 20 percent% of for their services by using 45K2D47BXG as coupon voucher.

Also, for those who had subscribed to the marketinout.com , please leave me an email @ sgwyckoffvsa@gmail.com and I will take my time and teach you personally how to correctly scan for stocks effectively via a one-one webinar session.

-------------------------------------------------------------------------------------------------------------------------

Last Friday was window dressing but there was one particular that caught my attention before Friday's spurt. It was Sembcorp marine. Not much about its fundamental as I believe most analyst house has a fundamental strong buy call on SembCorp Marine...

On its TA : triple bottom + potential breakout from a triple top position as well. Strong closed from ytd (take note that it was window dressing, so might not mean anything afterall)

Next...on Yangzijiang (whose

See the similarities between this 2 stocks, Hankore & Yangzijiang. And also the news that had happened. Early this May, Hankore also had similar news.... Yangzijiang could potentially do a "hankore". Watch out for the no supply bar. Interestingly, sell down occurs on window dressing, volume could be exaggerated but I wouldn't be surprised if share prices were whacked down purposefully.....But do not catch a falling knife. Please practice risk management.

Lastly, I will end of this post with some of the scans results from marketinout.com

Went through some of the scan results, and QAF's chart is definitely worth noticing...

Comments

Post a Comment