Market outlook 9th Feb

A good Sunday to everyone. It has been a really good year for me so far and I hope the same for everyone too!

Just want to a have quick update on DJI and STI before the week ends...I haven't been updating regularly in the blog, but I been posting quite a fair bit in my facebook.

If you always dwell on the daily chart, there is a slight chance that you will be missing the important details of the trades. Wyckoff methodlogy dwells on the tape, all the single transactions that makes up the candle. A lower time frame might on occasions give a better reflection on the market, but that depends on whether the lower time frame chart has signals on it.

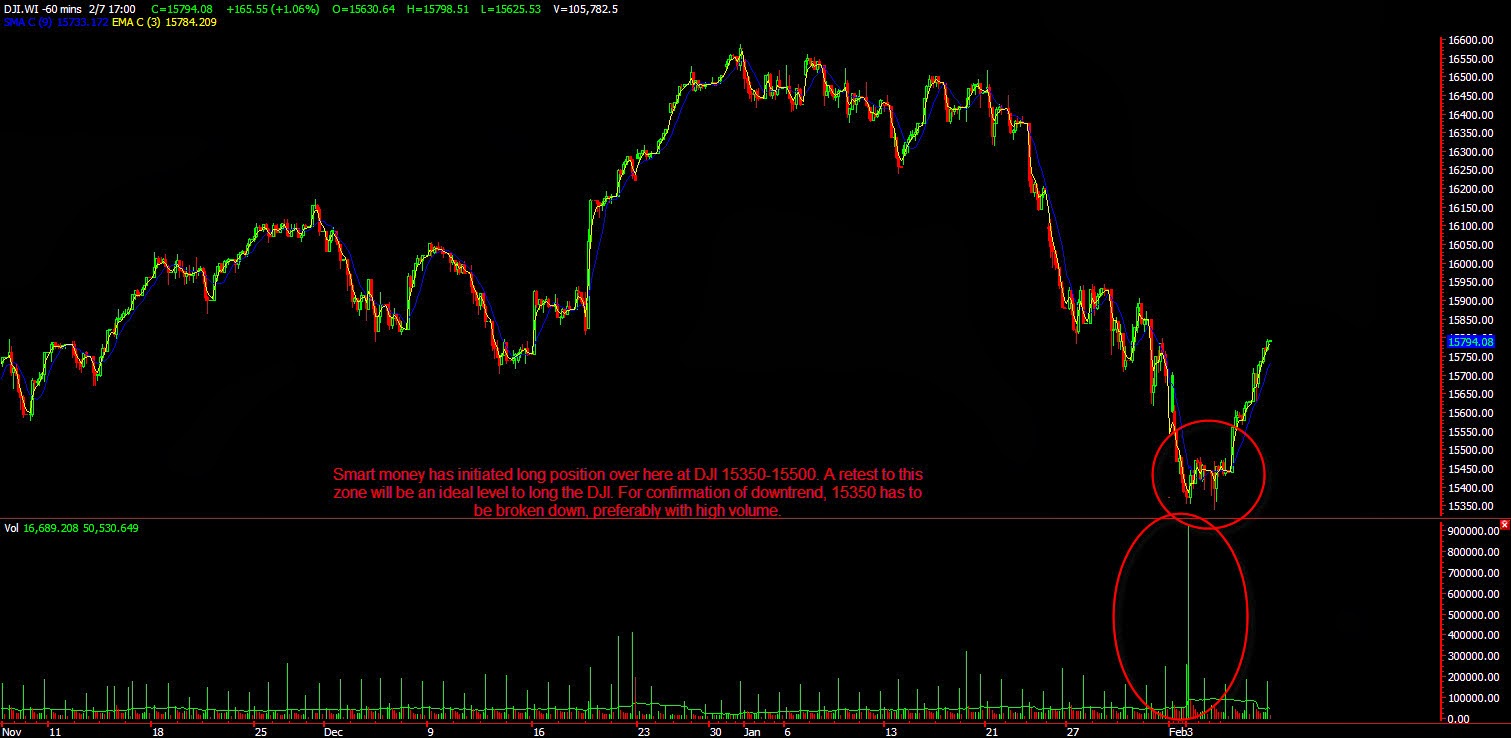

A good example will be on the chart of DJI. Smart money has accumulated on the cheap and has prevented the DJI from avalanche down lower. Whatever it is, it seems that we might be on track for a short term rebound.

These are the initial resistances levels that I will be wary of.

As for our local Singapore market, SGX just announces major potential "game changing" announcement. In short, contra period got shorten and it is required to have at least 5 percent of the trade size needed as collateral. I will be staying out on the local market till it digested the news.

Below are the charts of STI, daily and hourly.

Take note that first resistance in my chart is approaching at around 15940..market did went higher for the last 2 days.... GMT +8 11.28pm

ReplyDelete