MarketinOut Scans - Week 6

Did some scans using Marketinout propietary scanner today. Result was very good. Basically, the scanner helps me to find out what are the stocks that has characteristic of a test bar/stopping volume for eg.

Below are 3 pages of scans, same criteria, but different example. Criteria of my scan was on low volume, down bar, hall-mark characteristic of a test bar. Probably the best signal in using VSA/Wyckoff!

You may go to the tabs or click here if you are interested in the scanner. They provide a daily scan for free. Do let me know if you want to find out more about the software too.

Charts of my interests are ....

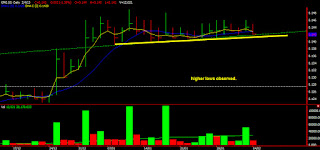

Additional note on GMG : I like its strong accumulation recently. BB is very much in play.

To scan for Whyckoff you must look for value stocks, stocks that lost public interest with future potential. These would be stocks who have accumulated at least 1 year and they must have a bear market behind them. This is Whyckoff. VSA is about the trend, whyckoff is about determining what the next trend will be. The Whyckoff trading trading range represents long term, from the second test which generally represents a double bottom to the cause where leadership comes in to testing. Testing generally comes after you have seen a higher low as this represents share pick up then a spring or shakeout may follow once evidence of accumumation exist. Higher highs form when buyers are getting more aggressive by raising buying limits. Any aggressive move up shows supply and this must be tested to collect shares as tells the sponsors there are shares at the highs on rises which they must absorb after the cause in the testing phase. The lower tops in the range shows the supply on rises has been taken in as the sponsors is holding the bag causing a shortage of stock.. One the lows are tested then you have seen dimished supply on rallies and reactions. This would cause a sign of strength either from a shakeout or accross the creek. This is Whyckoff, if you can read the trading range, you master The supply and demand relationships and when price is ready for the next trend. Scan for stocks that have fallen 30 %, price to sales below 2, P/E lower then 10, low debt, float below 200, have lifted 10% off the lows puts the stock near the end of the trading range. In other words, a value scan are your best opportunities for Whyckoff. Use compare strength, compare rallies and reactions in relation to the market. Relative strength do not use, strength comes on the compared waves to the market. Chose the stoch that shows comparitive strength as this has the greatest potential.

ReplyDeleteFrom my post above, to find Whyckoff trades go to Finviz, choose the scanner / screener. The fields is performance: year below 30%, in the field Hi / Lo, choose 10% above the low. For value the field P/E, below 10, this would choose stocks that are not bullish, price to sales below 2. ROE, Low debt is optional. When viewing the charts, choose weekly. You will find stocks under long accumulation. Any stock that has lifted 10% off the low has future potential and most likely absorbing supply. Whyckoff stated in his teachings that a position 1 is a stock that has the potential to lift from the lows 10% off the lows and a position 2 is a stock on the springboard ready for the mark up. This scan puts a stock in a potential #2 position, a stage at or near the end of a trading range however testing may take 90 days to complete or it may be ready to go go go. Using the week chart would be ideal for the testing phase. Do not expect high growth from a Whyckoff trading range but do expect slow growth to turn into high growth eventually. A long term trend would be confirm by re-accumulation so do not jump ship just because price falls. Focus not on short term selling, do however focus on intermediate selling. Intermediate selling would define a long term trend. VSA teaches the trader get in then get out.. This not Whyckoff, you buy value, follow the trading through rallies and reactions, hold through declines. Anytime a trend is broken, re-accumumation occurs, it's your job to determine if the selling will break the long term or if re-accumulation would continue the bullish objectives by the operators. If you are a buy and hold trader then Whyckoff is for you, if you want to swing trade then VSA is best. Understand this and don't confuse the two. In it's original form, Whyckoff teaches investors while VSA teaches traders how to trade.

ReplyDelete