Diary Post - Review

The current rally reminds me of what happened in early Jan last year, when most of the public are willing to invest in. Most importantly, from a chart perspective, we see similar patterns in their activities as well. Mainly a double bottom and a trendline breakout. I usually don't trade on breakout but I think at current market condition when everyone is feeling "bull", we gotta trade on breakout and ride as long as possible.

I feel that the our Index is taking on a risk-on approach in the upcoming year. If you have plans to make purchases for some good fundamental stocks and is waiting for better entry prices....you might want to buy a portion at the moment first and locked in some of the prices..Just in case market does not have a major correction this year....I myself have missed some good dividend paying stocks - Neratel.

Ok, now lets take a look at a few stocks that you might be interested in....

TatHong

Any pull back is a buy.

While I doubt that we will see any major correction, $1.40 is a major support for Tat-Hong at the moment. I think my house de analyst got a fair value target of $1.70. Not sure if it will soon move towards this price....Btw, it showed some decent entry prices prior its run up.

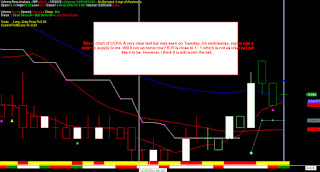

CCFH

Hankore

Looking good from the chart as well. 43 cents is largely accumulated.

No chart as it was rather straight forward.

Kreuz

With promotion of Kreuz to mainboard and good momentum in the O&M sector, I expect Kreuz to break its one year high of 46 cents and go even higher.

I feel that the our Index is taking on a risk-on approach in the upcoming year. If you have plans to make purchases for some good fundamental stocks and is waiting for better entry prices....you might want to buy a portion at the moment first and locked in some of the prices..Just in case market does not have a major correction this year....I myself have missed some good dividend paying stocks - Neratel.

Ok, now lets take a look at a few stocks that you might be interested in....

TatHong

Any pull back is a buy.

While I doubt that we will see any major correction, $1.40 is a major support for Tat-Hong at the moment. I think my house de analyst got a fair value target of $1.70. Not sure if it will soon move towards this price....Btw, it showed some decent entry prices prior its run up.

CCFH

Hankore

Looking good from the chart as well. 43 cents is largely accumulated.

No chart as it was rather straight forward.

Kreuz

With promotion of Kreuz to mainboard and good momentum in the O&M sector, I expect Kreuz to break its one year high of 46 cents and go even higher.

Comments

Post a Comment