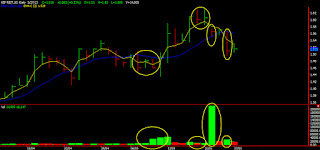

Some noteworthy charts for tomorrow. As a whole, a lot of ppty stocks were scanned, sinarmas and singholdings, not posting them because had already ran too much. Weehur , tuan sing and oxley to be laggard play? Oxley and weehur looking really good. Oxley with strong married trades and closing higher. No corp announcement tho. . Weehur : just amazed at how much trades were traded on the day. Bottoms out too. NOL: seems bottomed out and shows sign of its early day reversal. Tuansing : volume picking up but overhead resistance at 37cents, temporary. ChuanHup: Spotted like months ago during accumulation, don't chase. While close is at 29 cents, trades before closing was only 28 cents. Serial : 125 will be a very strong support. Highlighted 2 weeks back.