End Of March Update

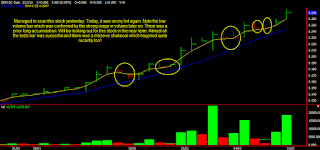

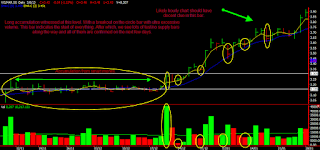

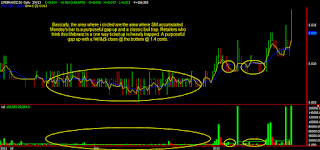

Been waiting for the pennies to die off before charts become more favourable to see. Like the Hokkien song, "Wu Xi Ki, Wu Xi lou". Stocks can't forever go up, you need a rest, a pit stop just like a human. Thus a retracement is definitely necessary if we are going higher. Other bluechips stocks that I have paid a some attention was Cland and Wilmar which had a massive sell down last last Friday. Someone in my fb page actually felt that there is a potential massive selling wave coming for these 2 stocks but well, you shouldn't be worrying now at least. This was the exact reply on wilmar when the massive sell down volume was seen. Having said that, while we are currently in the bull market, please do take profits as and when possible along the way!