NOL and Noble Group -

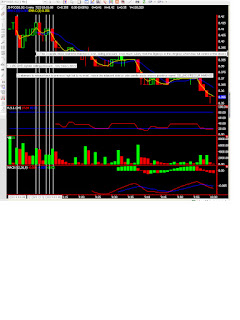

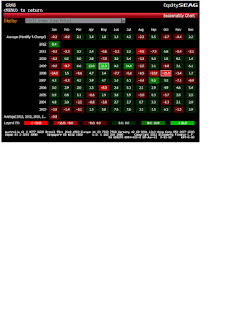

Good evening all, Attached below are all my opinons. This is strictly not a buy/sell recommendation. Please make your own investment decisons when doing trades. Below are 2 charts attached for Noble and Nol. These 2 counters have not been doing very well during for the past 2 financial results. Definitely not up to analysts expectation. Today, both Noble and NOL are @ resistant and they could potentially faced with more downwards pressure in days to come. Noble opens at 1.075 today, down 1 cents from Friday's closing and closed at 1.045. Its recent low was back at around May-June period when it briefly touches 1.05 and rebounded back sharply. Will noble retraces back this time round? My opinon is no. This counter can potentially be as cheap as 80 cents , according to fibonacci retracement. With the index trending at around 2982 at today's closing, down 33 points. the STI index still has the capacity to fall to its recent low of 2700. With renewed